As Africa gears up to harness its gas resources for both domestic consumption and international markets, the United States is increasingly recognizing liquefied natural gas (LNG) as a pivotal avenue for investment, alongside traditional oil exploration.

Recent projections by energy research and consultancy group Wood Mackenzie in October 2023 highlighted Africa’s ambitious $800-billion, 20-year upstream capital expenditure program, poised to yield world-class LNG projects in Mozambique and floating LNG (FLNG) ventures across five countries.

This presents significant gas-driven opportunities for U.S. investors, operators, project developers, and service providers.

Set against this backdrop, the forthcoming Invest in African Energy (IAE) forum, scheduled for May 14-15 in Paris, emerges as a crucial platform to showcase trade, partnership, and investment prospects for U.S. companies across Africa’s energy supply chain.

With participants from diverse projects spanning the continent, the event aims to catalyze regional African gas markets while capitalizing on growing U.S. interest in African energy initiatives.

While American companies already play a leading role in Africa’s burgeoning LNG industry, there exists ample scope to expand their involvement, particularly in FLNG projects.

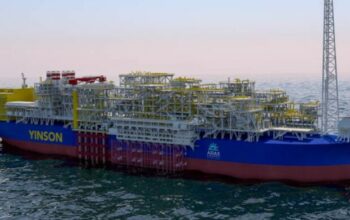

FLNG offers enhanced flexibility, reduced time to market, and suitability for smaller gas volumes. Projections from energy intelligence provider Westwood Global Energy indicate a promising outlook for the global FLNG market, with Africa expected to dominate short-term investments.

By 2027, an estimated $35 billion in new investments will add 18.3 million tons per annum (mtpa) of additional capacity, with an associated engineering, procurement, and construction (EPC) contract value of $13 billion.

Beyond 2027, a further 36.5 mtpa of capacity is anticipated, with an EPC value of $22 billion. The IAE forum will spotlight the projects and companies driving these capacity expansions, along with unveiling new ventures in the pipeline.

In Equatorial Guinea, U.S. operators and contractors spearhead the Gas Mega Hub (GMH) initiative, aimed at monetizing stranded gas fields in the Gulf of Guinea to facilitate intra-African LNG trade.

Notably, Chevron’s Noble Energy E.G. achieved first gas from the project’s initial phase and subsequently inked a Heads of Agreement with Houston-based Marathon Oil and the Equatorial Guinean government to develop phases two and three.

Additionally, plans for West Africa’s first LNG storage and regasification plant, the Akonikien LNG Terminal, proposed in 2019, involve American manufacturer Corban Energy Group.

Mozambique emerges as another strategic market for U.S. gas investments, having surpassed $1 billion in LNG exports as of last November.

American multinational ExxonMobil leads the development of the $23-billion Rovuma LNG project, expected to reach a final investment decision in 2025, employing a phased construction approach.

With a targeted capacity of 18 million tons per year, the facility promises to provide reliable, affordable energy to local markets while catering to global demand.

In neighboring South Africa, ExxonMobil explores the feasibility of an LNG regasification terminal to enhance access to low-cost, reliable fuel.

Such initiatives position the U.S. to contribute to bolstering Africa’s gas transport, storage, and regasification capabilities, in addition to supporting the establishment of power stations and associated infrastructure.

With world-class LNG developments on the horizon, including bp’s Greater Tortue Ahmeyim LNG in Senegal and Mauritania, Perenco’s Cap Lopez LNG Terminal in Gabon, Eni’s Congo LNG in the Republic of Congo, and UTM Offshore’s pioneering FLNG project in Nigeria, the United States stands poised to solidify its market leadership in Africa’s on- and offshore gas industry.

Dubbed the “fuel of the future,” LNG is primed to play a pivotal role in shaping Africa’s energy landscape and contributing significantly to the global energy mix in the foreseeable future.

![]()