The Angolan Mining, Oil and Gas (AMG) is a multi channel digital platform that reaches the Angolan mining, oil and gas industries with relevant, up to date news, tenders and latest developments. Managed by a team of experts in the online and digital media, you are assured of top and commercially relevant news updates.

We disseminate our news through five digital platforms that are AMG Website, AMG Weekly Newsletter, AMG HTML Mailers, AMG Digital Magazine and AMG Social Media Pages. With these digital platforms we offer rare opportunities to industry player for publicity as well as exposure of their products and services to the entire mining, oil and gas industries in Angola.

Mining in Angola

Mining in Angola is an activity with great economic potential since the country has one of the largest and most diversified mining resources of Africa. Angola is the third largest producer of diamonds in Africa and has only explored 40% of the diamond-rich territory within the country, but has had difficulty in attracting foreign investment because of corruption (which the current government is trying its best to fight) and diamond smuggling. Production rose by 30% in 2006 and Endiama, the national diamond company of Angola, expected production to increase by 8% in 2007 to 10,000,000 carats (2,000 kg) annually. The government is trying to attract foreign companies to the provinces of Bié, Malanje and Uíge. Angola has also historically been a major producer of iron ore.

Diamond mining

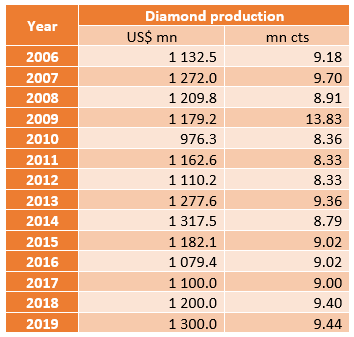

In Angola, diamonds are the second leading export for the country behind oil. Diamond mining in Angola dates back to 1917 when a consortium of Belgian, English and Portuguese investors established Companhia de Diamantes de Angola, or Diamang. In 1961, a civil war broke out in Angola against the Portuguese colonialism. In 1975, Angola gained independence. In 1981, ENDIAMA, Angola’s state-owned diamond company, was set up based in Luanda, the capital of Angola. In 2002, Angola joined the Kimberley Process Certification System. At the end of July 2020, the annual report for 2019 was released as indicated below.

Diamond production in Angola, 2006-2019

Oil and Gas Industry

Angola is the second largest oil producing country in sub-Saharan Africa and an OPEC member with output of approximately 1.3 million barrels of oil per day (bpd) and an estimated 17,904.5 million cubic feet of natural gas production. Due to a significant drop in oil prices and limited foreign currencies in the Angolan market, very limited investment in either new or mature exploration and production fields has occurred since 2014. The limited investment in turn has led to a drop toMar the current daily lifts of 1.3 million barrels of oil per day (bpd), far below capacity. However, announcements of investments and discoveries over the last year were expected to boost production starting in 2020.

International oil companies currently operate under joint ventures and production shared agreements with Sonangol. Operators include; Total, Chevron, BP, ExxonMobil, Statoil and ENI. Apart from these companies, China’s national oil companies – Sinopec, China National Offshore Oil Corporation (CNOOC) and New Bright International Development (Hong Kong) are currently involved in Angola mainly to provide development assistance and oil backed loans. In 2004, China Sonangol was established as a joint venture between Sonangol and New Bright International Development (EIA. 2016). China Sonangol and Sinopec have a joint venture with Sonangol Sinopec International which is a non-operator shareholder at three major deep water projects (EIA. 2016). The relationship between Sonangol and New Bright International Development has often been questioned as the Hong Kong based company has quickly become a dominant player in the Angolan oil industry.

Angola has approximately 9 billion barrels of proven oil resources. About 75% of Angola’s oil production comes from offshore fields. The crude oil produced, contains low volumes of sulfur which is suitable for processing light refined petroleum products. The oil rich continental shelf of the Angolan coast is divided into 55 blocks which is expected to be auctioned between 2019 to 2025.

General Strategy for the Refining Sector in Angola

Currently, Angola depends almost entirely on the import of refined products, mainly gasoline and diesel, which are widely used in transport and in the growing industry. In this context, in order to eliminate this dependence, the Angolan government defined a strategy that allows national and foreign groups to invest in the oil refining industry in order to build new refineries.

As part of this strategy, investments are underway in the Luanda Refinery, which has a nominal refining capacity of 65,000 bopd, and at this stage some technical and operational improvements are taking place to increase the production of gasoline and diesel, in addition to improving the quality of these products.

Additionally, the Cabinda Refinery is projected to start operating in 2022, with a refining capacity of 60,000 bopd, while the Soyo Refinery is projected to start operation in 2025, having a production capacity of 100,000 bopd.

Other minerals in Angola

Angola has vast mineral resources: gold, platinum, nickel, chrome, iron, copper, manganese, kaolin, gypsum, quartz, zinc, phosphates, granite, marble, uranium, lead, wolfram, tin, fluorite, sulphur, feldspar, mica, asphalt, and talc. While rough indications of the location of mineral resources are easily available, only 31 % of the country has been accurately geologically mapped (Ministry of Geology, Mines and Industry, 2010). The mineral industry in Angola today includes metals (copper), industrial minerals (cement, diamonds and gypsum; granite, marble, and salt), and mineral fuels (petroleum) (Bermúdez-Lugo, 2011; Coakley, 2003).

![]()