Tanzania and Uganda Target July 2026 for First Oil Exports via EACOP

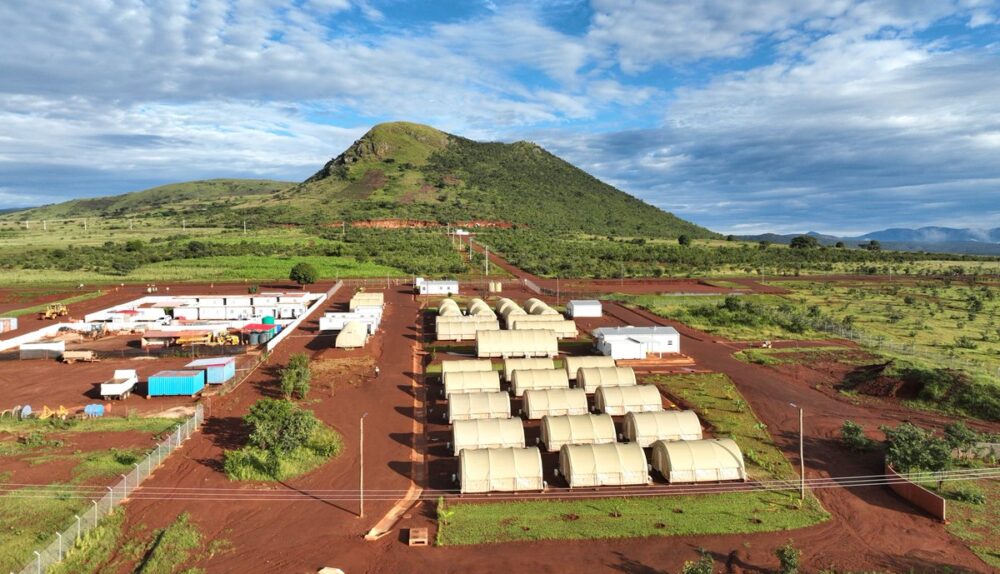

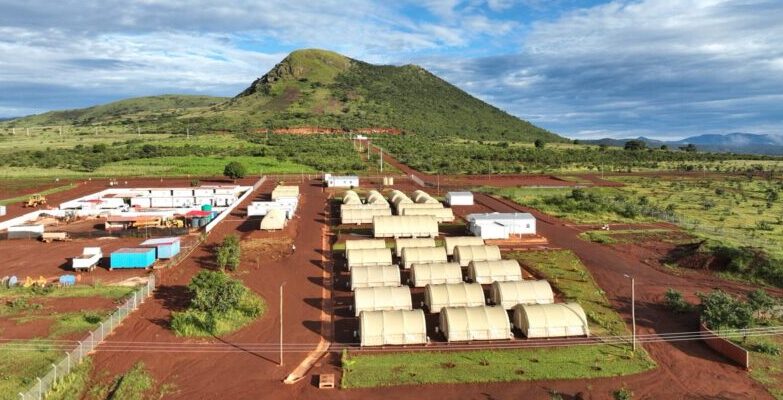

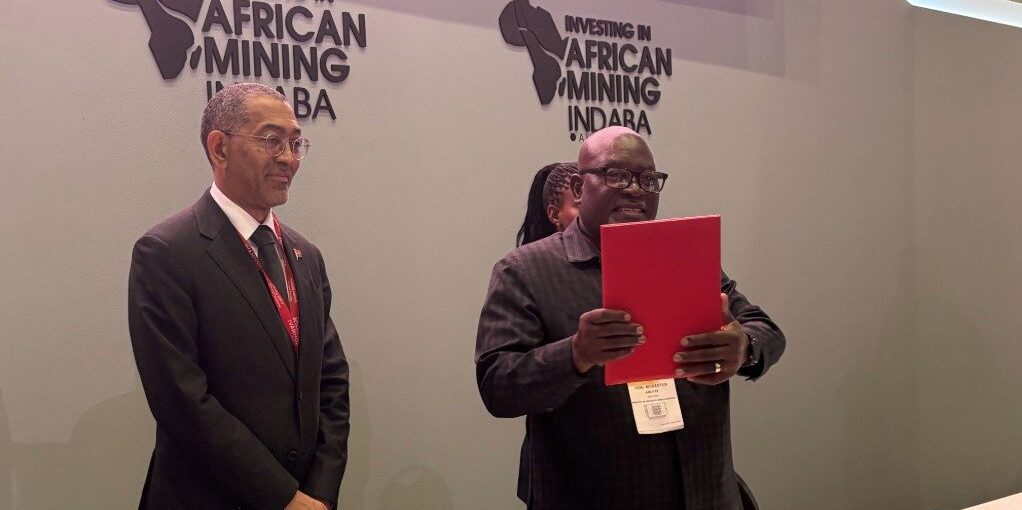

East African Crude Oil Pipeline Nears Completion as Uganda and Tanzania Plan First Oil Shipment in July 2026 Tanzania and Uganda are preparing to launch their first crude oil shipment through the East African Crude Oil Pipeline (EACOP) by July 2026, following high-level talks between Tanzanian President Samia Suluhu Hassan and Ugandan President Yoweri Museveni. Officials from both countries confirmed that technical coordination is underway to finalize export readiness, including operational procedures and supporting infrastructure

![]()