Mozambique’s presidential candidates are advocating for the renegotiation of contracts related to the nation’s major projects with developers, a move that could potentially delay the construction of liquefied natural gas (LNG) facilities by TotalEnergies SE and ExxonMobil Corp.

Daniel Chapo, the candidate from the ruling Liberation Front of Mozambique (Frelimo), expressed last month that contract revisions should be conducted on a case-by-case basis.

This sentiment has been echoed by candidates from three opposition parties, sparking a national debate ahead of the presidential elections scheduled for October 9.

A key concern among candidates is that Mozambique does not derive sufficient benefits from its agreements with multinational investors.

According to World Bank data, nearly three in four Mozambicans lived on $2.15 or less per day last year, a decline from a decade earlier.

The government estimates that the LNG projects could contribute nearly $100 billion to national revenue over their lifetime.

Joaquim Chissano, Mozambique’s longest-serving president, welcomed the debate, emphasizing the need for the country to be better prepared for negotiations with multinational corporations. However, project developers have expressed concerns regarding potential policy changes.

“It’s crucial for us to have assurance that the new president will maintain the existing policy concerning these large projects,” said TotalEnergies CEO Patrick Pouyanne during a July 25 investor call. He urged for clarity by the end of the year on how to proceed.

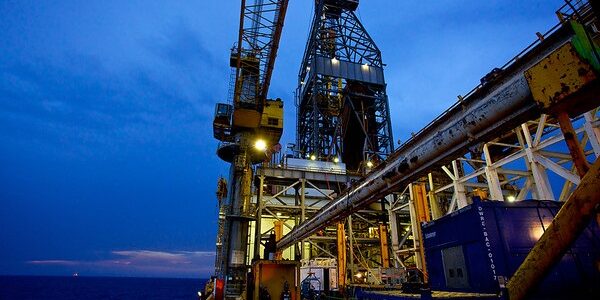

TotalEnergies is leading a $20 billion LNG export project in the northeastern Cabo Delgado province, which has been on hold since 2021 due to attacks by an Islamic State-backed insurgency. Similarly, Exxon’s investment has also faced delays.

While campaign statements may not necessarily translate into policy changes post-election, experts caution against dismissing them.

“The rhetoric may reflect election posturing rather than a genuine shift toward resource-nationalist policymaking,” said Anne Frühauf, managing director at risk advisory firm Teneo.

“However, such statements can create significant uncertainty for investors, especially with a presidential transition on the horizon.”

It remains unclear which specific mega-project contracts could be targeted for renegotiation. Nevertheless, the candidates’ statements are generating considerable apprehension among investors.

A 2014 law that established a special legal framework for projects by TotalEnergies and Exxon in the Rovuma Basin limits the government’s flexibility in renegotiating these contracts.

Fatima Mimbire, a social activist and opposition Democratic Movement of Mozambique candidate for governor of Maputo province, noted that any changes would require reopening contractual negotiations. “The companies are protected by stabilization clauses, meaning a government cannot arbitrarily alter the terms of a contract,” she stated.

![]()