Sociedade Mineira do Lulo plans to bid, at auction, for three heavy diamonds, weighing 12, 50 and 180 carats, benefiting from the fact that the stones from that concession continue to be attractive and attract buyers on the international market, despite the price crisis.

The president of the Management Board of that Minas Gerais company, Alfredo Machado, stated that, besides these three rare stones, the company does not have any other production in stock, given the market’s appetite for their production. The average price of diamonds extracted from Lulo is two thousand dollars per carat.

“We do not have diamonds in stock, except for the three special stones of 180, 50 and around 12 carats that are waiting to be sold at auction”, a bidding process organized by the National Diamond Trading Society (Sodiam), which has exclusive rights for the transaction of Angolan diamond production.

Semiannual production

The president of the Management Board of Sociedade Mineira do Lulo announced, in contact with the press, that production in the first half of the year was between 15 and 16 thousand carats, more than 85 percent of what was planned, with the expectation that , at the end of the year, reach a volume between 30 and 40 thousand carats.

These projections give peace of mind to the company owned by the Angolan capital of Endiama and Pétalas e Rosas and the Australian capital of Lucapa Diamond Company, according to Alfredo Machado, who highlighted that there are no forecasts for large investments, not even in removal or prospecting equipment, for now occurred in 2022: “the mine has what it needs at this moment”, he said.

From 2018 to date, Sociedade Mineira do Lulo has invested around 38 million dollars in different operational areas, maintaining the tendency to continue extracting large diamonds, as this is the characteristic of the concession in which it operates, at least until the next two years, taking into account that the average diamond size in that area is one carat per stone.

Concession expansion

Despite the slight stability, the partners of the Lulo mine are concerned about the current reserves, and are analyzing whether the amount of mineralized gravel in the concession compensates the operating costs, and could be facing a scenario that Alfredo Machado considers “complicated” for the continuity of the operation.

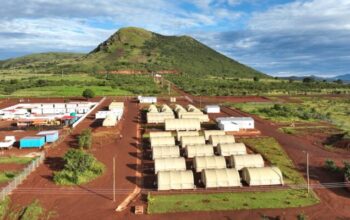

If the new reserves are not incorporated into the current reserves, of three thousand square kilometers, the risks could include reducing the number of workers, with a view to keeping mining operations functional, or closing the mine, which, with 215 workers, in 2018 , now employs 630.

The company is in the process of receiving a new washing plant for sampling in the areas where mining occurred, to test the volume of gravel and provide guarantees to partners for another five years, having proven, through geological-mining studies, that the operations mining companies can continue “calmly” for the next two or three years.

After investments of ten million dollars last year, negotiations are planned between partners with a view to extending the concession area.

Prices affect production in Endiama mines

The Calonda and Lunhinga Mining Companies, located in Lucapa, Lunda-Norte, and owned by Endiama, operated, in the first half of the year, at 97 percent of production capacity, above the company’s mining ventures with a performance of 30 to 40 percent. lower than the installed capacity, Jornal de Angola, in Dundo, learned from an official source.

Endiama’s administrator for Mining Operations, Participation Management, Audit and Quality Control, Laureano Receado, told the press that both in the case of Calonda and Lunhinga, as well as in the companies with lower performance, the difficulties are attributed to the financial crisis and the drop in diamond prices on the international market.

Despite the operational difficulties, he continued, the prospects are encouraging, predicting that, by the end of this year, new equipment will be installed at the Calonda mine, at the same time that a restructuring process is taking place that includes the recovery of the mine’s treatment plant of Lunhinga until the end of the fourth quarter.

“Currently, in both projects, production levels are around 97 percent of planned levels. We have constraints due to the huge drop in the price of diamonds around the world”, he said.

Despite the adversities, it has currently been possible to keep all diamond projects functional.

All of Endiama’s diamond projects are operational, with none out of operations, said Laureano Reaceado at the company’s Semiannual Production Balance meeting in Dundo, involving representations from the country’s 20 main producers, with the participation of the president of the Board of the company’s Administration, Jose Manuel Ganga Júnior.

![]()