Lucara Diamond Corp. has announced that its 2024 revenue projections have been revised downward due to reduced sales of high-value diamonds, which typically account for up to 70% of its annual revenue, and ongoing softness in the global diamond market.

In its third-quarter update, the company adjusted its full-year revenue guidance to $160 million–$180 million, down from the previous range of $220 million–$250 million.

While other operational guidance remains unchanged, Lucara lowered its 2023 capital expenditure estimate for the Karowe underground expansion in Botswana from $100 million to $80 million. The overall project, valued at $683 million, is expected to reach full production by 2028.

Lucara’s high-value diamonds, defined as stones over 10.8 carats, are sold through a 10-year agreement with Antwerp-based HB Group.

For the first nine months of 2024, revenue from sales to HB Group was $80.6 million, a decline from $88.8 million during the same period in 2023.

The company also reported $20 million in deferred sales revenue from HB Group for its 549-carat Sethunya diamond, recovered in 2020.

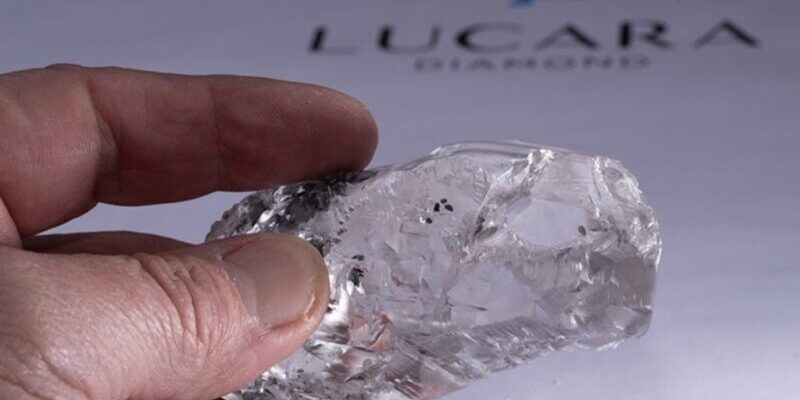

Additionally, Karowe continues to yield exceptional recoveries, including a 1,094-carat diamond in September and a 2,492-carat diamond—one of the largest since the 3,106-carat Cullinan diamond in 1905—recovered just a month prior.

CEO William Lamb highlighted challenges in the smaller diamond segment due to weak demand in Asian markets and the rise of lab-grown diamonds.

However, he expressed optimism about the potential impact of G7 sanctions on Russian diamonds larger than one carat, effective March 2024, which could bolster prices by increasing scrutiny on diamond provenance.

“Lucara, with its established operations producing exceptional Botswana diamonds, stands to benefit from this heightened focus on origin verification,” Lamb noted.

To address potential disruptions in cash flow and production, Lucara plans to stockpile mill feed to compensate for a mid-2025 shortfall in open-pit ore supply.

These stockpiles will sustain operations until 2027, when high-grade ore from the underground mine is expected to come online.

Delays in Karowe Expansion

The Karowe underground expansion has faced setbacks, including shaft-sinking delays due to unforeseen geological challenges. T

hese issues led to increased capital expenditures and project delays, contributing to the resignation of former CEO Eira Thomas in 2023.

Despite the challenges, Lamb emphasized Lucara’s resilience: “The long-term outlook for diamond prices, combined with the potential for exceptional stone recoveries and the continued strong performance of the open pit, could mitigate the impact on project cash flows caused by schedule changes.”

Lucara remains focused on navigating the transition from open-pit to underground mining while leveraging its premium diamond production to maintain its market position.

![]()