Lewcor Holdings has leveled accusations against its Zimbabwean equity investor, RZ Murowa Holdings, alleging the unauthorized stripping of assets from the Elizabeth Bay Mine in Namibia.

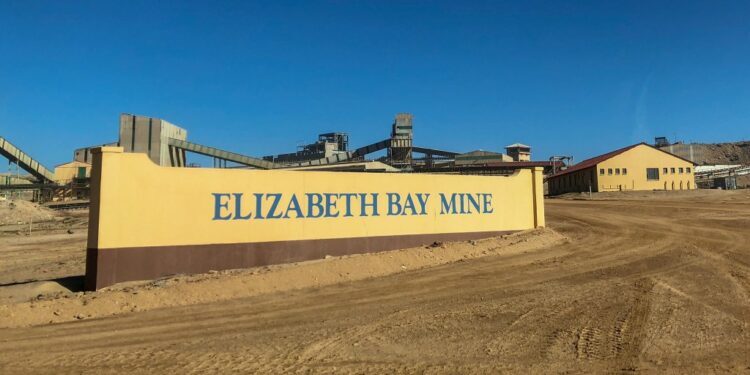

The Elizabeth Bay Mine, owned by Sperrgebiet Diamond Mining, commenced operations in 1911. In 2019, Namdeb Holdings sold the mine to the Lewcor Group, with plans to restart operations after it had been under care and maintenance.

In 2020, RZ Murowa, a member of the Global Emerging Markets Group, was brought in as an equity investor to revive the mine.

Under the agreement, RZ Murowa invested N$100 million in the first phase and intended to invest an additional N$200 to N$250 million in the second phase to ramp up production.

However, operations began in September 2022 and ceased abruptly in March 2023, with Lewcor filing for liquidation on 14 December 2023.

Lewcor, through its chief operating officer Thiaan Lewis, has approached the Windhoek High Court seeking an urgent order to halt RZ Murowa from stripping the mine’s assets until the liquidation request is heard.

Lewis alleges that RZ Murowa’s actions of stripping assets without clearing debts amount to unfair advantage-taking and jeopardize the mine’s future operations.

In response, Sperrgebiet Diamond Mining’s acting CEO, Abraham Grobler, clarified that the sale of assets to RZ Murowa in June 2023 was in compliance with existing contractual obligations.

Grobler asserted that the sold assets were redundant or obsolete and not essential for the mine’s downsized operations.

The case has been postponed to 9 February for judgment by Judge David Munsu, as both parties await a resolution to the contentious dispute.

![]()