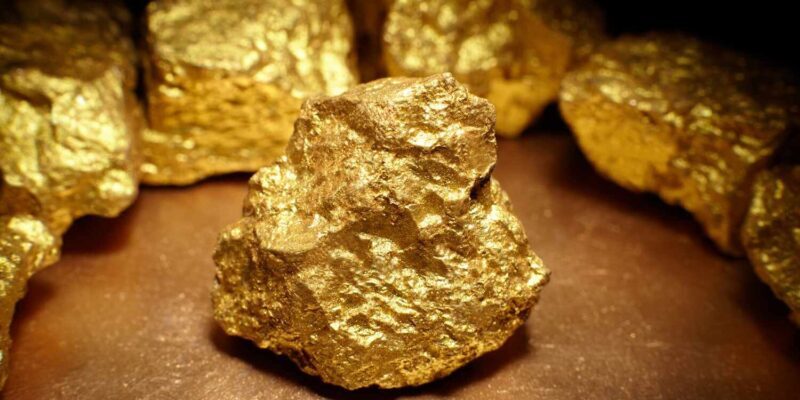

Gold prices fell again on Tuesday as a recovering U.S. dollar took its toll, with prices heading for a fifth day of losses in six sessions after the biggest pullback since February last week.

Price action

- Gold futures for June delivery GCM23, -0.33% fell by $15.80, or 0.8%, to $1,961 per ounce on Comex.

- July silver futures SIN23, -1.01% declined by 55 cents, or 2.3%, to $23.20.

- Palladium for June PAM23, -2.02% fell by $29, or 2%, to $1,463 per ounce, while July platinum PLN23, -1.00% declined by $10.20, or 0.9%, to $1,067 per ounce.

- Copper for July delivery HGN23, -1.45% fell by 6 cents, or 1.5%, to $3.63 per pound.

Market drivers

Gold prices have pulled back since the most-active contract logged its second-highest settlement level on record on May 4. It was the highest settlement since the all-time high reached in August 2020.

Whether the yellow metal rallies again is a question facing traders and analysts who have blamed the yellow metal’s troubles on the resurgence of the U.S. dollar.

Also: Stocks may take a hit by June if the dollar keeps rising, analyst says

“In the past two weeks, the US dollar has shown signs of a short-term bullish resurgence,” said Kelvin Wong, senior market analyst at OANDA.

The ICE U.S. Dollar Index DXY, +0.31%, a closely followed gauge of the dollar’s value against other major currencies, was up 0.3% at 103.52 on Tuesday. Over the prior two weeks, the index has risen by 2%, its best such streak since September.

![]()