Galp has finalized the sale of its stakes in key projects in Mozambique and Angola, marking a strategic shift in its portfolio.

In May and June 2024, the Portuguese energy company sold its blocks and shares in these regions, starting with a significant transaction involving the Abu Dhabi National Oil Company (ADNOC).

Reuters and Bloomberg first reported in May that Galp sought to sell a 40% stake in the Mopane discovery PEL 83 in the Orange Basin.

Galp, holding 80% of this project, with Namcor and Custos Energy each holding 10%, entered into an agreement to transfer its upstream assets in Mozambique to ADNOC.

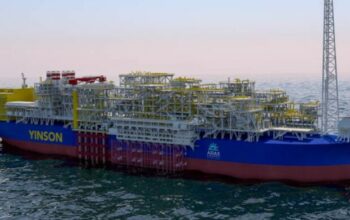

ADNOC, a diversified energy group owned by the Abu Dhabi government, acquired Galp’s shares in Mozambique’s Area 4, which includes Coral South FLNG, operational since 2022, and the prospective Coral North FLNG and Rovuma LNG onshore developments, expected to be sanctioned in 2024/25.

This transaction supports Galp’s disciplined capital expenditure strategy, netting the company C$650 million, already adjusted for capital gain taxes.

Additionally, contingent payments of US$100 million and US$400 million will be made upon the final investment decisions for Coral North and Rovuma LNG, respectively.

The Rovuma basin in Mozambique is one of the most significant gas discoveries in the past fifteen years, holding proven reserves to ensure a stable natural gas supply to both FLNG and onshore facilities.

The 18-mtpa Rovuma Onshore LNG development features a modular, electric-drive design that significantly reduces the carbon intensity of LNG production, aligning with ADNOC’s goal of achieving net-zero emissions by 2045.

Coral South FLNG can produce up to 3.5 mtpa of LNG and is the first facility of its kind in Africa. Coral North is expected to match this capacity.

In Angola, Galp completed the sale of its assets to Sociedade Petrolífera Angolana S.A. (now Etu Energias), the largest private Angolan oil and gas company.

The deal, initially signed in February 2023, involved onshore assets FS, FST, CON-1, and CON-6, and offshore Block 2/05 in the lower Congo Basin. Etu Energias also holds interests in Blocks 3/05, 3/05-A, 4/05, 14/14K, and 17/06.

Galp sold its stakes of 9% in Block 14, 4.5% in Block 14K, and 5% in Block 32 for a total of C$830 million, including C$655 million payable upon completion and C$175 million in contingent payments due in 2024 and 2025, dependent on Brent prices.

Block 32, a major producer since 2018, is located 260 km off Luanda in water depths of 1,400 to 2,000 meters and is operated by TotalEnergies Exploration Production Angola, alongside Sonangol, SINOPEC, ExxonMobil, and Galp Energia Overseas.

Block 14/14K, producing since 1999, covers around 4,094 km² offshore from Cabinda and yields significant medium-light crude oil outputs, operated by Chevron.

Local authorities and regulatory bodies have fully approved these transactions. Financing was provided by an international syndicate led by the African Export-Import Bank (Afreximbank), including Shell Western Supply and Trading Ltd, Banco Angolano de Investimento (BAI), and Banco de Fomento Angola (BFA).

These strategic divestments enable Galp to streamline its operations and focus on its core projects, ensuring sustainable growth and shareholder value.

![]()