De Beers plans to partner with the Botswana government on exceptional diamonds under the parties’ new sales deal, enabling the country to derive more benefit from its priciest stones.

The contract calls for opportunities to share an interest in the final polished revenue, said Paul Rowley, De Beers’ executive vice president for diamond trading, in an interview. These would be investments, meaning that Botswana would also take on risk, Rowley pointed out.

“We all know that exceptional stones carry a higher risk, but also potentially a higher return,” he said.

De Beers and Botswana signed an “agreement in principle” last Friday on a new pact setting out the sales system for diamonds from Debswana, the pair’s 50:50 joint venture.

The arrangement will last for 10 years once the parties have ironed out the final details. They also agreed on a 25-year mining license enabling De Beers to continue extracting material from the Jwaneng and Damtshaa mines through 2054. The current mining contract expires in 2029.

High-value diamonds were reportedly a central issue in the protracted negotiations, which saw more than two years of delays.

The parties wrapped up the outstanding aspects of the deal around 15 minutes before the deadline of 12 a.m. on Friday night, Rowley said.

Under the current deal, De Beers and Botswana have rotating access to special and exceptional stones. This will remain the case under the new system, but De Beers will offer the government more partnerships on an optional basis.

This model was not written in the old agreement; De Beers did occasionally offer them to the government, but there was no uptake, Rowley said.

The focus will be rough stones worth $500,000 or more, he added.

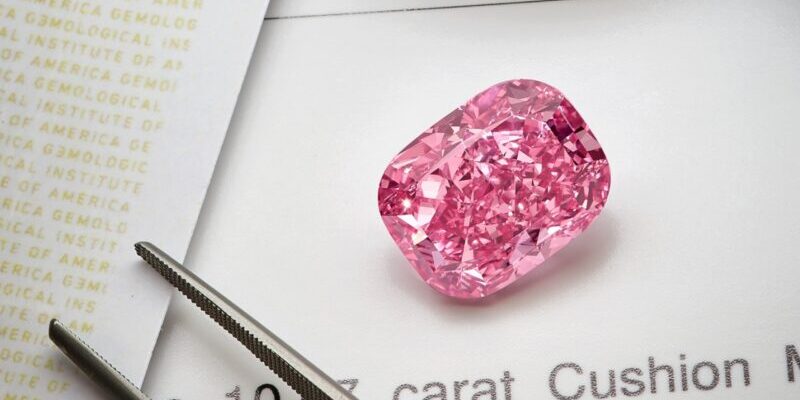

The executive gave the example of a pink rough diamond weighing 23.78 carats from Damtshaa that sightholder Diacore manufactured into a cushion-cut, 10.57-carat, fancy-vivid-purplish-pink, internally flawless polished. The piece sold for $34.8 million, or $3.3 million per carat, at Sotheby’s New York last month.

That case “has shown what can be created and what can be done and how we can actually help put Botswana on the map,” Rowley explained. This, he said, can stimulate interest among high-end consumers and help Botswana’s tourism industry.

Local trade

The regular and unexceptional goods — known as run-of-mine production — will go to De Beers or state-owned trader Okavango Diamond Company (ODC) for selling, as they do now.

However, the split will change. ODC currently receives 25% of the diamonds — a percentage that applies to both value and volume, given the relative consistency of the production.

When the new deal goes into effect, this proportion will rise to 30%. After five years it will become 40%, and when 10 years have passed it will reach the final target of 50%, Rowley said.

Until then, the terms of the old contract — which expired on June 30 — will remain in place. Rowley predicted this could continue for months.

Shareholders of Anglo American, De Beers’ parent company, will need to approve the final agreements.

De Beers’ annual sales to cutting factories in Botswana will likely stay at the 2022 level of just under $1.1 billion, Rowley estimated.

At some point, the miner intends to partner with an as-yet-unnamed sightholder to establish a jewelry-manufacturing facility in the country, he revealed.

It will also work to set up grading facilities in Botswana under its De Beers Institute of Diamonds, enabling an entire “ecosystem” to support the local trade, he said.

Impact on sightholders

De Beers will maintain its sight system, though inevitably a smaller proportion of Debswana rough will be allocated to those sales as more goes to ODC.

(Rowley would not say whether ODC would start its own system of contract sales.) Other impacts on customers remain unclear for now.

“I’ve had a lot of reassured sightholders sending through their congratulations and perhaps relief” at the new sales and mining deals, the executive related.

“Over time, we’ve evolved, and that’s the way the sightholder system has worked. We’ve evolved through our contracts with the way we operate, and we’ll continue to do so,” he concluded.

![]()