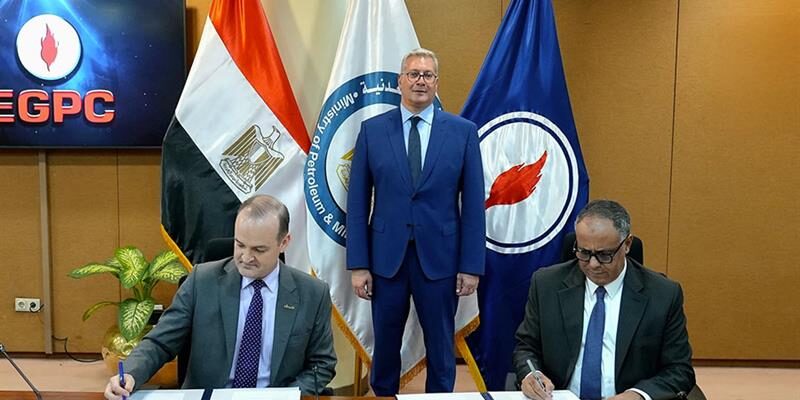

Egyptian General Petroleum Corporation Enters $6.5 Million Oil and Gas Deal with Terra Petroleum The Egyptian General Petroleum Corporation (EGPC) has signed a $6.5 million oil and gas exploration agreement with UK-based Terra Petroleum, marking the company’s first entry into the Egyptian energy market. Under the terms of the agreement, Terra Petroleum will drill three exploration wells in the Northwestern El Moghra concession in Egypt’s Western Desert. The company will also conduct comprehensive 2D and

![]()