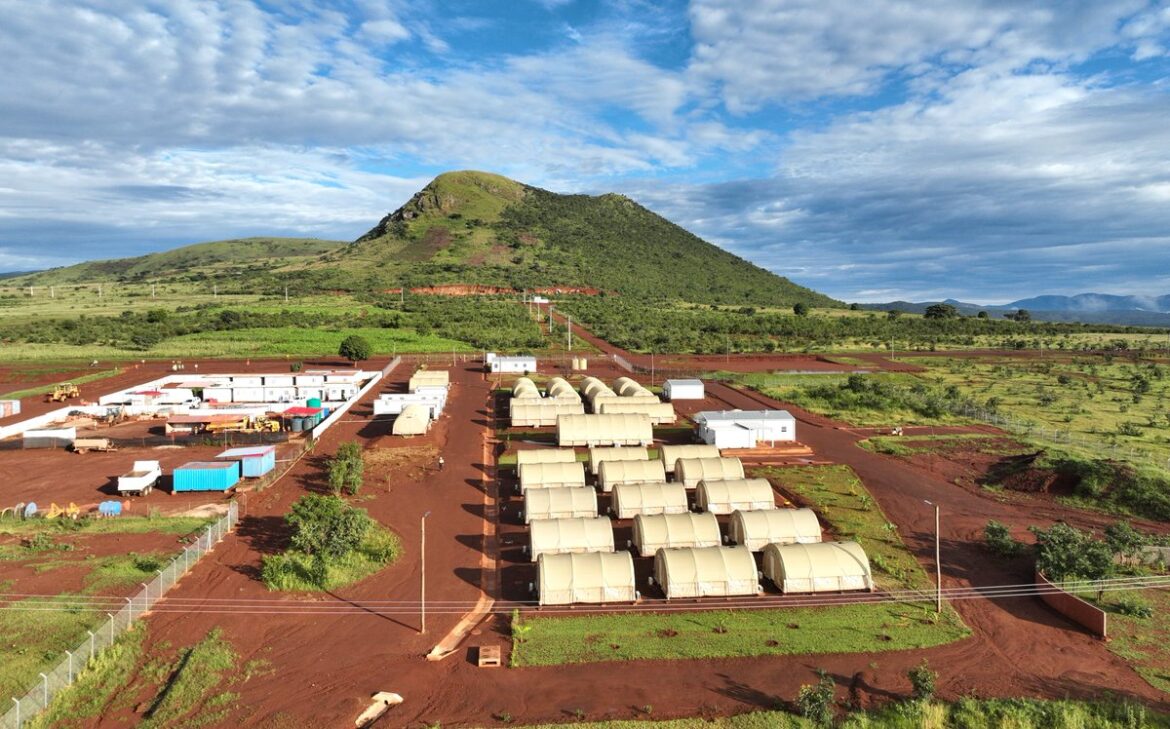

Cascade Natural Resources Raises Pensana Investment to $165M to Support Angola’s Longonjo Rare Earths Mine Global rare earths investment platform Cascade Natural Resources has increased its strategic investment in London-listed Pensana to $165 million, strengthening support for the company’s US-focused mine-to-magnet supply chain strategy. Cascade had initially committed $100 million, but the revised agreement expands the investment to accelerate development of key rare earth assets, particularly the Longonjo Rare Earths Project in Angola. Under the

![]()