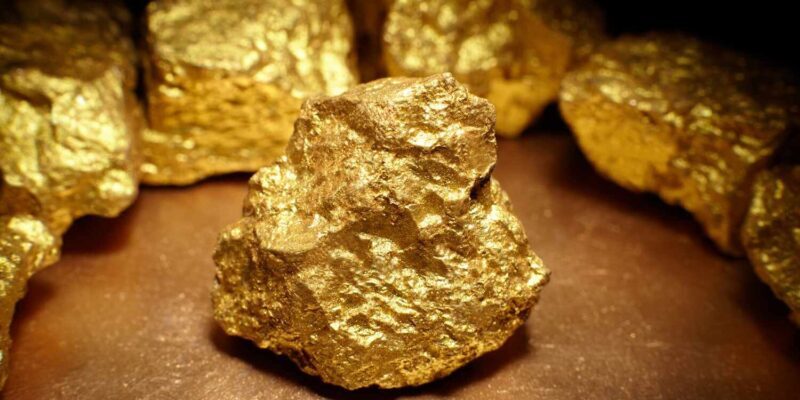

Triton Minerals Ltd (ASX:TON) has entered into a binding Memorandum of Understanding (MOU) to acquire up to 80% of the Aucu gold and copper project in Mozambique’s central-west Tete province. Spanning 588 square kilometers, the project is strategically located near existing infrastructure and active gold and coal mining operations. It lies approximately 45 kilometers from Tete, the provincial capital, and just 200 kilometers south of Africa Lion Gold’s Chifunde Gold project. The area’s well-established mining

![]()