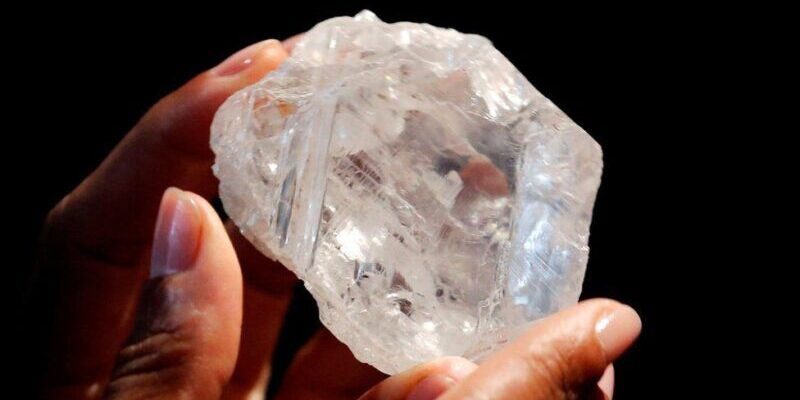

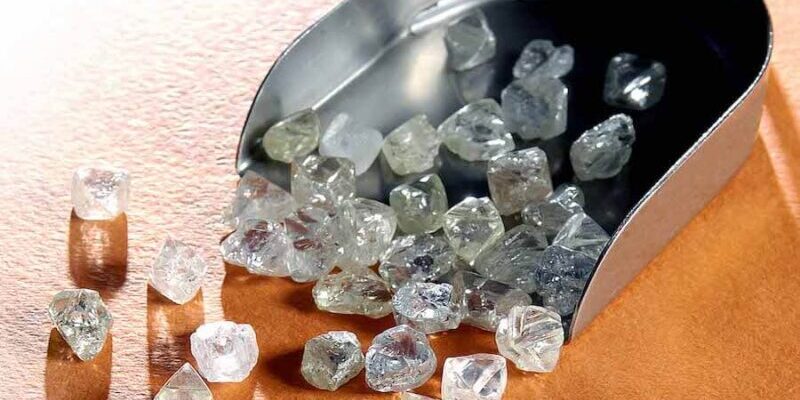

Angola’s Sodiam to Hold Online Auction of 36 Specialty Diamonds in October 2025 The Angolan state-owned diamond trading company, Sodiam, has announced an electronic auction of 36 specialty diamonds, each weighing 10.80 carats or more. The auction will be held in collaboration with TRANS ATLANTIC GEM SALES, targeting customers registered in Sodiam’s database who have expertise in trading specialty stones. According to Sodiam’s official press release, viewing sessions for the diamonds will take place from

![]()