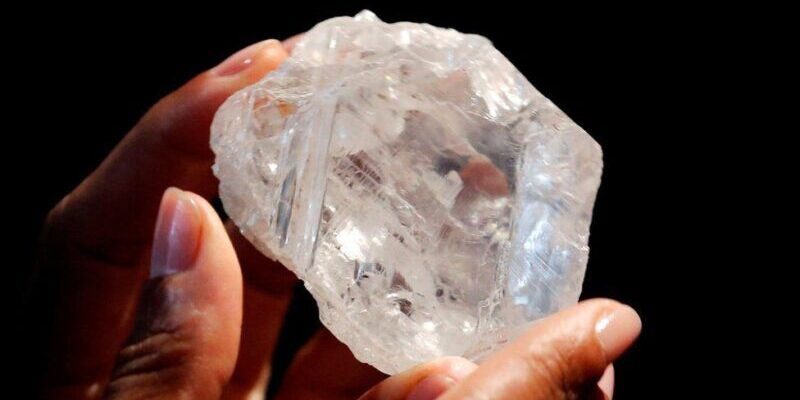

The National Diamond Trading Company of Angola (SODIAM) raised, this Friday 19th April, 17 million dollars with the sale of 636.28 carats (auction of 20 special stones). According to a press release, these are rough diamond productions from the Mining Companies of LULO SOMILUANA, CHITOTOLO, UARI and KAIXEPA. The evaluation sessions took place from the 11th to the 18th of this month, at SODIAM’s facilities in Luanda, with bids being submitted electronically on the online

![]()