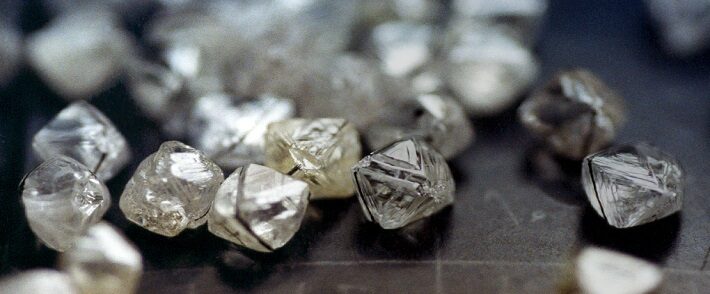

DIAMOND contracts are not, it seems, forever — unfortunately for De Beers. By the time the Anglo American firm brings a new marketing deal for shareholder approval, probably at Anglo’s AGM next year, it will be almost four years since the last deal expired, and six since negotiations began. For its pains the diamond giant is getting 70% of diamonds produced by Debswana, the 50/50 joint venture with Botswana’s Okavango Diamond Company. That’s 5% less than

![]()